Your company 's all-in-one compliance solution.

Put all ongoing compliance, filings, and reports on autopilot. Never miss a deadline.

More than a registered agent.

We offer much more than just a name on a piece of paper you 're used to seeing. That 's because our team understands the complex legal requirements in each state to let you operate and scale your business as freely as you want.

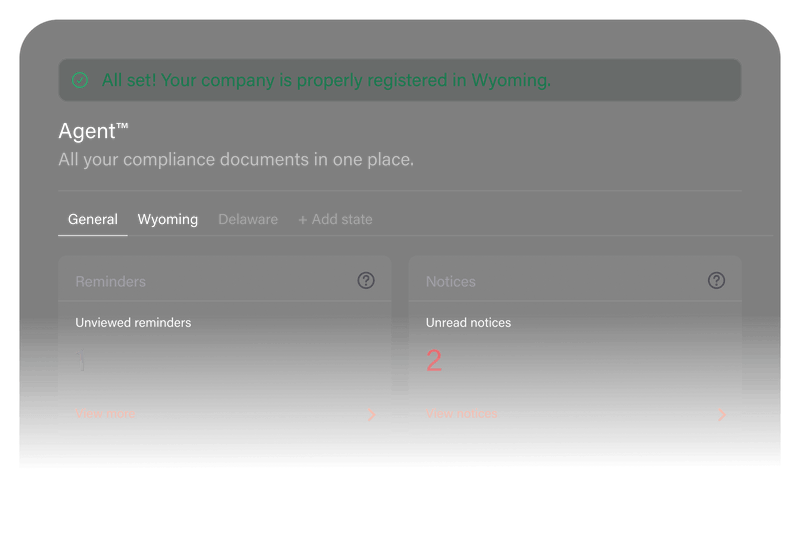

Automated peace of mind.

View all compliance documents and official mail in a centralized dashboard. We eliminate stashed drawers full of loose papers and overdue fees. Now, all your information, as soon as it 's available, is right at your fingertips.

One-click compliance services.

We monitor if your company is in good standing with all government agencies so we know what needs to be completed as soon it happens. At your request, we can also file your annual and franchise report.

An always-ready registered agent.

We act as your Registered Agent to track and communicate ongoing compliance needs in every state where your business operates. You don 't need to worry about deadlines or filing requirements.

.png)

Compliance in just one click.

Get integrated one-click services to manage more complex compliance

across multiple states effortlessly, so your business always stays one step ahead.

.png)

Save time on annual report and franchise filings

We’ve pre-filled all the required state and federal forms so you have everything you need to file accurately and fast. In every state that you operate.

Expand your business in more states.

We’ll register your company to transact in other states so you can build your business across state borders.

Set up compliant payroll in any state.

Register for Payroll™ to compliantly hire remote employees, process payroll, and file tax returns. Available in all 50 states.

Level up your compliance.

Whether you 're just getting started, or you need payroll tax registration, we 've got you covered. Choose the plan that 's right for you.

Light*

Autopilot*

Payroll*

Get Agent™ or switch to Agent™

State mail processing

State compliance reminders

Compliance tracking

dashboard to manage accounts

State annual reports

State franchise tax filing

Payroll tax registration

Coming Soon**

Payroll tax registration tracking

$99

per state / Yearly

$299

per state / Yearly

$599

per state / Yearly

Cost

*Plans do not cover any filing that is overdue or if the company is not in good standing.

**Track any state reminders/notifications on customer’s payroll tax accounts.

How to Get Started

Submit your business information.

Fill out some details about your company. We’ll legally change your registered agent in your incorporation state.

We’ll handle the paperwork.

Whether it 's annual reports, filings, or transacting in other states, we’ll manage your registrations through our online dashboard.

We’ll keep you compliant.

We’ll manage your ongoing compliance and keep you up-to-date on approaching deadlines and changes to compliance requirements as your company grows.

Frequently Asked Questions

What is a Registered Agent?

Why do I need a Registered Agent?

Can I do business without a Registered Agent?

What is Foreign Qualification and why is it important?

When Foreign Qualification is Required?

What is an Annual Report and why do I need to file one?

Get started with Firstbase

Start, grow, and manage your business. We 're with you each step of the way.